how can consumers help reduce infltion

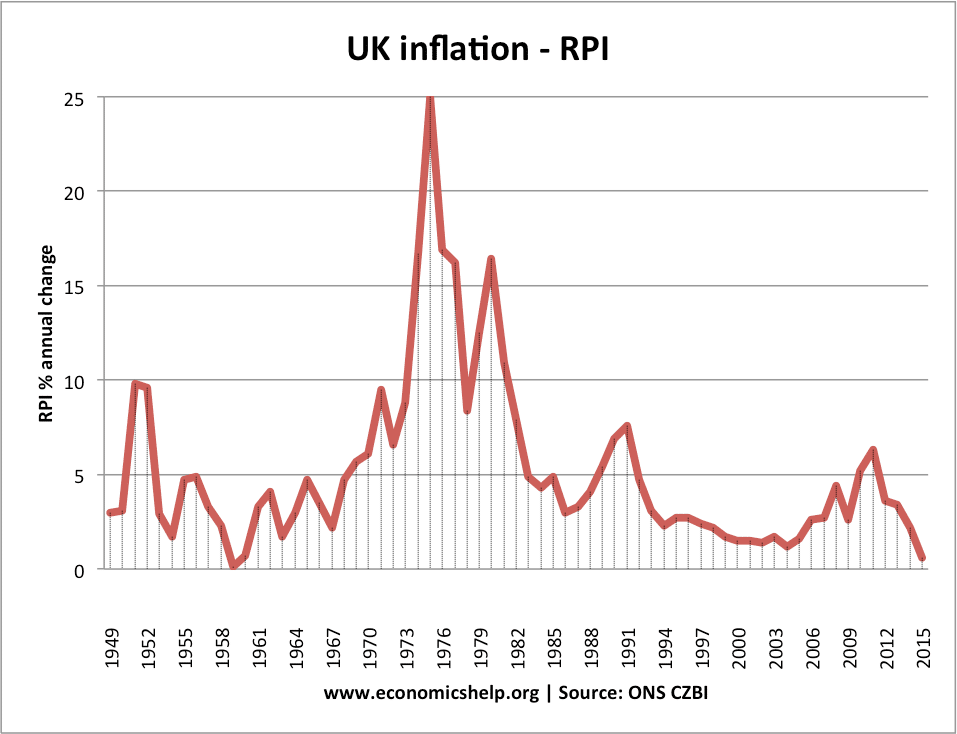

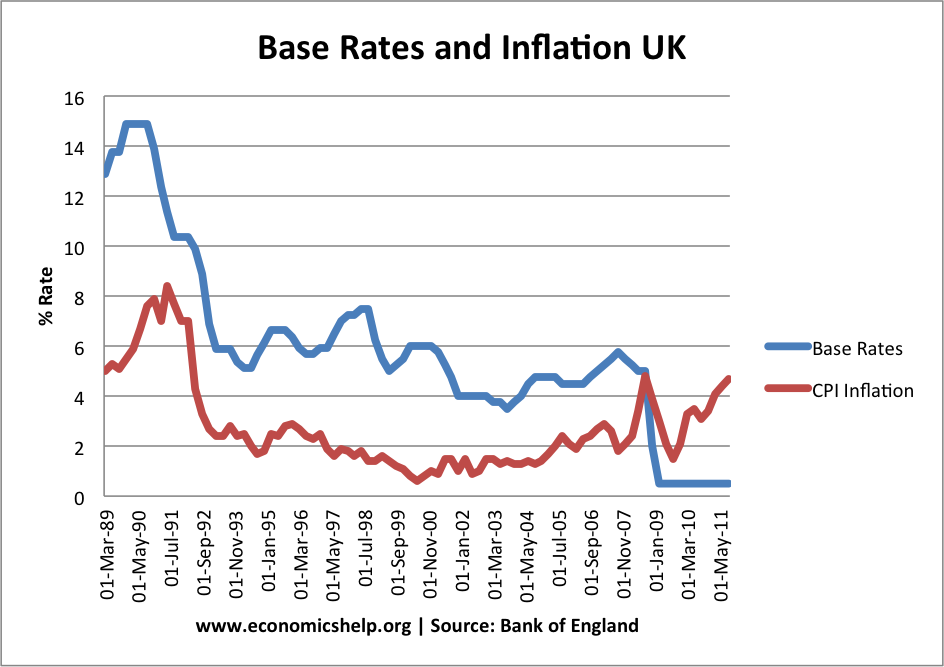

Monetary policy Higher interest rates reduce demand in the economy leading to lower economic growth and lower inflation. The best way to ration gas or any other scarce resource is to let the price rise to a point where the supply is sufficient to meet the demand.

Powell Will Take Action To Reduce Inflation As Soon As March Time

14 2022 at 543 pm.

. This provides another route to controlling inflation. This leads to lower economic growth and lower inflation. Here are ways you can directly reduce your car insurance rates or mitigate increases.

Federal programs that go to make up the deficits that can be met only by inflation. It does this with monetary policy. Monetary policy Higher interest rates.

Reducing spending is important during inflation because it helps halt. Therefore the stock market response to the announcement of a policy directed at reducing inflation measures whether the good effects of reducing inflation outweigh the bad. IiA reduction in taxes which increases risk-taking and incentives to work a cut in income taxes can be considered both a fiscal and a supply-side policy.

Control of money supply Monetarists argue there is a close link between the money supply and inflation therefore controlling money supply can control inflation. Hedging and diversification of business models can buffer against the risks of accelerating inflation. Can consumers inflation expectations help stabilise the economy.

During economic downturns the Fed may lower the federal funds rate to its lower bound near zero. These are ways of controlling inflation in the medium term. To deal with inflation what consumers should do to reduce inflation Consumers are always the victims of inflation unless they are rich and or do not care about the rise in commodity prices.

1 day agoWhile you cant control how insurers price their policies you can take action to avoid shouldering higher costs. Eventually all the gas is gone but consumers still have gas money burning holes in their pockets. By Ioana Duca-Radu Geoff Kenny and Andreas Reuter 1 Economists have argued that when interest rates set by policymakers cannot go any lower the economy can be stabilised if consumers expect the rate of inflation to increase.

The Feds ideal inflation rate is around 2if its higher than that demand will drive up prices for too few goods. Price limits may in principle help alleviate inflationary pressures by attempting to regulate wages. This increases the cost of borrowing and discourages spending.

To control inflation the Fed must use contractionary monetary policy to slow economic growth. Nonetheless apart from the 1970s it was scarcely used. Gathering broader deeper data on consumers can provide insights for sustaining customer loyalty Deloitte said.

As Ive said in a previous post the high inflation weve seen this fall isnt very broad based. But there are steps you can take to get through. Governments can lower or restrict the growth of prices of items that play a big part in the CPI thereby reducing the average change in prices.

Despite the lack of confidence most people express about stocks owning some equities can be a very good way to combat inflation. Price comparison sites like Experians auto insurance comparison tool can help you ensure youre not overpaying for. Over the last 40-years weve had an experiment in what causes inflation One suggestion is that the too much money part of the too much money chasing too few goods usual definition of inflation comes about because of.

Think of your household as a business. Instead only four out of about 200 price categories are driving inflation well. Tight fiscal policy Higher income tax andor lower government spending will reduce aggregate demand leading to lower growth and less demand-pull inflation.

In such times if additional support is desired the Fed can use other tools to influence financial conditions in support of its goals. Investment in data analytics while also maintaining demand can help reduce input costs. Answer 1 of 4.

Carlson says inflation is at 119 year over year the highest level weve seen since 1990. It also means there is less available credit which can reduce spending. IA reduction in company taxes to encourage greater investment.

If thats not enough try looking for new sources of income to make ends meet such as. And the stronger demand for goods and services may push wages and other costs higher influencing inflation. In short during this period of inflation we need to track our expenses and budget more carefully.

However the reduction in inflation may increase future profits and reduce interest rates - which is good for the market. Doing so will also help us spend our money more wisely so we can get through this period of inflation with minimal losses. A higher rate of income tax could reduce spending demand and inflationary pressures through fiscal policy.

Biden has a long-range plan to reduce inflation but consumers and voters want to see prices dropping in the near term Published. To deal with inflation with the desire to reduce inflation prevent the recurrence of repeated recurrence of inflation consumers can through the Consumer. Yet the evidence for this stabilising.

This will help us understand our spending habits and categorize wants and needs. If you find yourself facing higher expenses than your benefits can meet you can look for costs you can cut to free up money in your budget. The Fed can slow this growth by tightening the money supply.

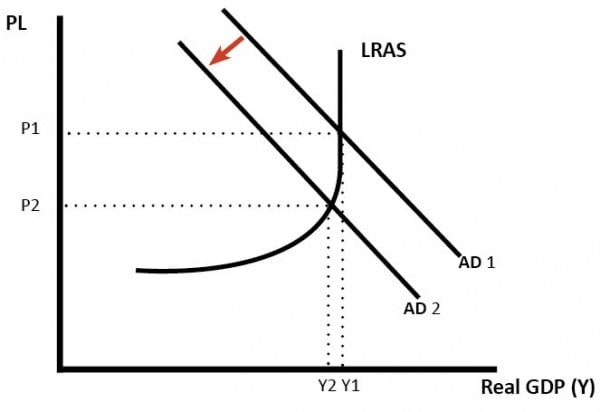

Policies To Reduce Inflation Economics Help

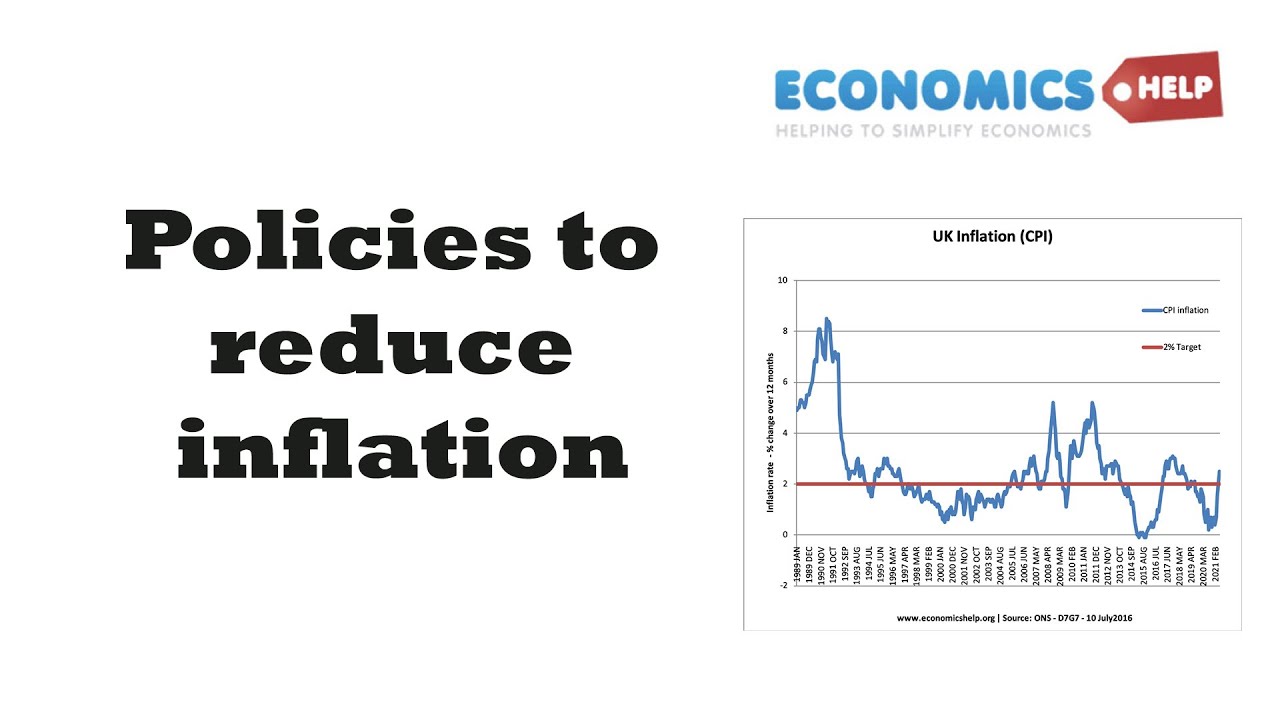

Methods To Control Inflation Economics Help

Policies To Reduce Inflation Economics Help

Policies To Reduce Inflation Economics Help

Methods To Control Inflation Economics Help

Crude Oil Price Fall In Global Crude Price May Ease India S Import Bill And Inflation Crude Energy Oils Oil And Gas

Policies To Reduce Inflation Economics Help

What Are The Importance Of Investment Investing All About Insurance Savings Bank

May 2021 Newsletter Fiscal Driven Inflation Fiscal Bank Lending Consumer Price Index

0 Response to "how can consumers help reduce infltion"

Post a Comment